We will follow them through a series of hypothetical transactions and look at how each of these transactions would be recorded on the balance of payments. However, for some time, it will be common for individuals to use the term “capital account” to refer to the present “financial account.” So be warned.Ĭonsider two individuals, one a resident of the United States, the other a resident of Japan. This category is very small, including such items as debt forgiveness and transfers by migrants. A capital account stills exists but now includes only exchanges in nonproduced, nonfinancial assets. Note that in June 1999, what was previously called the “capital account” was renamed the “financial account” in the U.S. Any time an item in a transaction is an asset, the value of that item will be recorded in the financial account. Any time an item in a transaction is a good or a service, the value of that item will be recorded in the current account. resident and a foreign resident would result in an entry on both the domestic and the foreign balance of payments accounts, but we will look at only one country’s accounts.įinally, we will classify entries in the balance of payments accounts into one of the two major subaccounts, the current account or the financial account. Note that each transaction between a U.S. account, the values of all entries are denominated in U.S. In the following examples, we will consider entries on the U.S. Any time an item is imported into a country, the value of that item is recorded as a debit entry on the balance of payments.Any time an item (good, service, or asset) is exported from a country, the value of that item is recorded as a credit entry on the balance of payments.There are two simple rules of thumb to help classify entries on the balance of payments: This interpretation in the balance of payments accounts can be misleading, however, since in many international transactions, as when currencies are exchanged, money is involved on both sides of the transaction.

#Debit credit examples plus

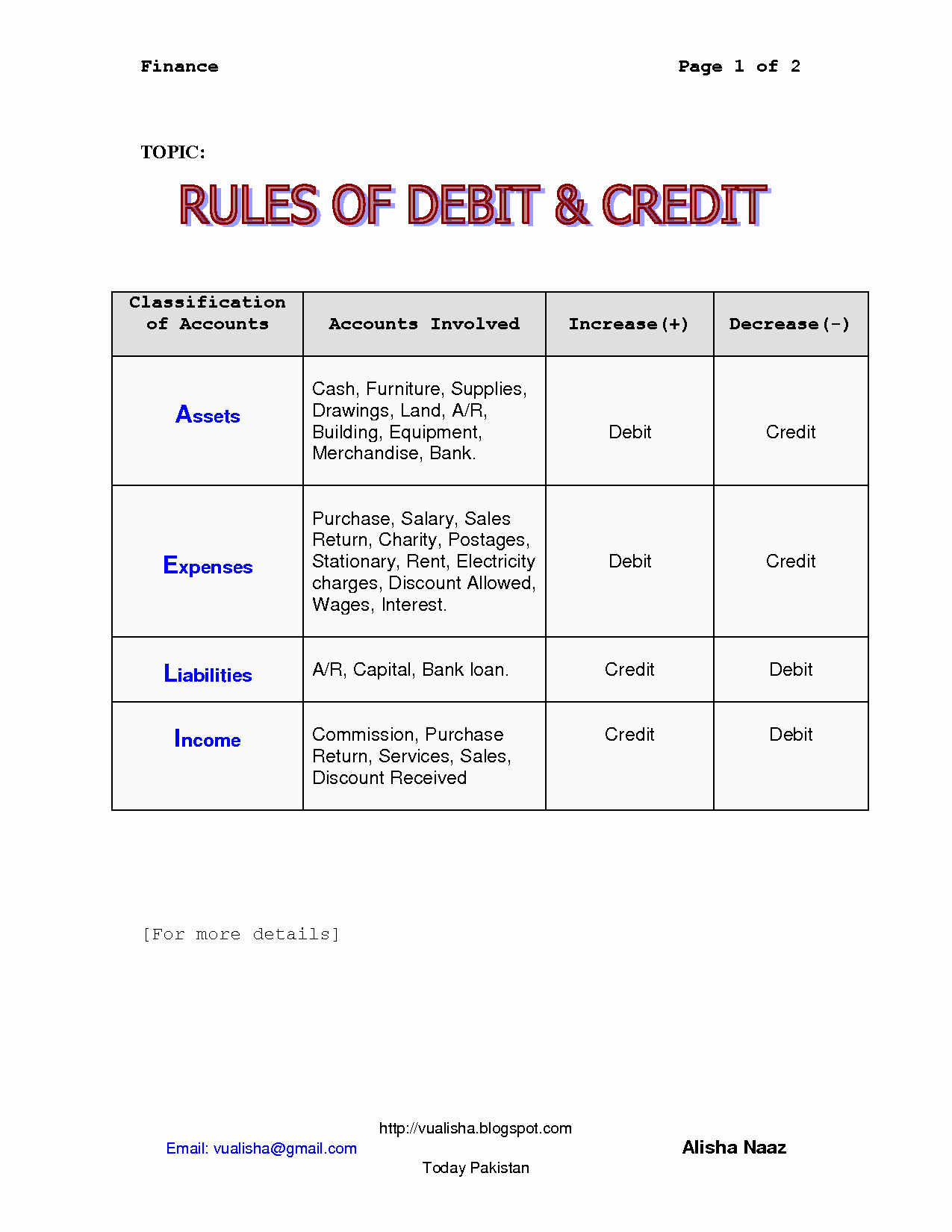

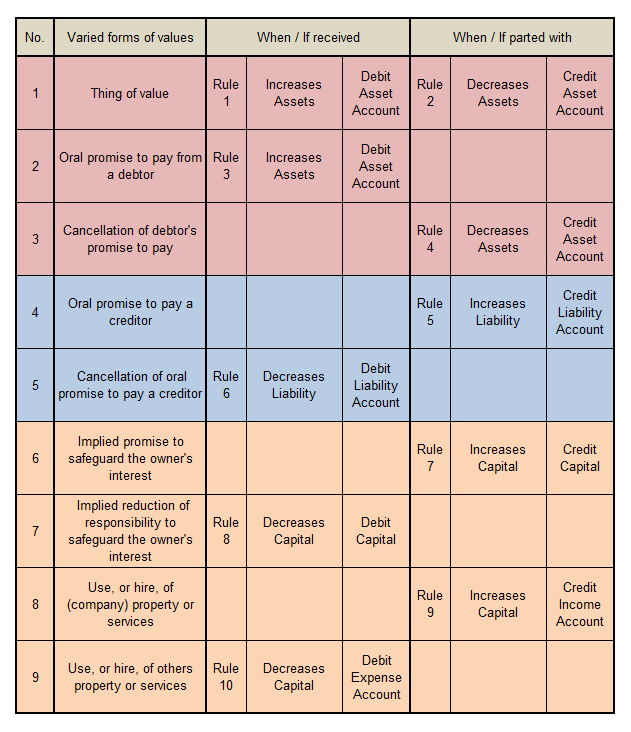

The plus on the credit side generally means that money is being received in exchange for that item, while the minus on the debit side indicates a monetary payment for that item. This means that every transaction must result in a credit and debit entry of equal value.īy convention, every credit entry has a “+” placed before it, while every debit entry has a “−” placed before it. The debit and credit columns in the ledger are used to record each side of every transaction. Thus if one person exchanges $20 for a baseball bat with another person, then the two items of equal value are the $20 of currency and the baseball bat. These transfers include pension payments to domestic citizens living abroad, foreign aid, remittances, and other types of currency transfers that do not include an item on the reverse side being traded. An exception is the case of unilateral transfers. The second column is used to record debit entries.Īlmost every transaction involves an exchange between two individuals of two items believed to be of equal value. One column is used to record credit entries.

The balance of payments accounts can be presented in ledger form with two columns.

In this section, we demonstrate how international transactions are recorded on the balance of payment accounts.

#Debit credit examples how to

0 kommentar(er)

0 kommentar(er)